In that case, the company may choose not to issue it as a separate form, but simply add it to the balance sheet. It’s also sometimes called the statement of shareholders’ equity or the statement of owner’s equity, depending on the business structure. Retained earnings play a crucial role in a company’s financial what does a statement of retained earnings look like health and have a significant impact on the shareholders’ equity. In a financial statement, retained earnings are reported under the shareholder equity section of the balance sheet. This account serves as a measure of the company’s ability to generate profit, reinvest, and create value for shareholders.

Who Creates the Statement of Retained Earnings?

Retained earnings act as a reservoir of internal financing you can use to fund growth initiatives, finance capital expenditures, repay debts, or hire new staff. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. At the end of 2019, John’s Bicycle Shop had retained earnings in the amount of $90,000, which can be used to invest back into the business, such as by purchasing a larger storefront.

- Shareholders equity—also stockholders’ equity—is important if you are selling your business, or planning to bring on new investors.

- Revenue, net profit, and retained earnings are terms frequently used on a company’s balance sheet, but it’s important to understand their differences.

- Your accounting software will handle this calculation for you when it generates your company’s balance sheet, statement of retained earnings and other financial statements.

- For instance, the first option leads to the earnings money going out of the books and accounts of the business forever because dividend payments are irreversible.

- The money can also be distributed to John, his brother, and his sister as a dividend, or some combination of the two options.

- Revenue sits at the top of the income statement and is often referred to as the top-line number when describing a company’s financial performance.

Retention Ratio and Dividend Payout Ratio

In the United States, it is required to follow the Generally Accepted Accounting Principles (GAAP). A statement of retained earnings shows the changes in a business’ equity accounts over time. Equity is a measure of your business’s worth, after adding up assets and taking away liabilities. Knowing how that value has changed helps shareholders understand the value of their investment. Investors pay close attention to retained earnings since the account shows how much money is available for reinvestment back in the company and how much is available to pay dividends to shareholders.

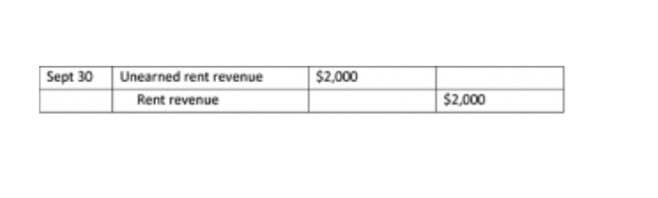

How to calculate the effect of a cash dividend on retained earnings

This information is crucial for making informed decisions about potential investments. They are a measure of a company’s financial health and they can promote stability and growth. Retained earnings are the portion of a company’s cumulative profit that is held or retained and saved for future use. Retained earnings could be used for funding an expansion or paying dividends to shareholders at a later date. Retained earnings are related to net (as opposed to gross) income because they are the net income amount saved by a company over time. When a company generates net income, it is typically recorded as a credit to the retained earnings account, increasing the balance.

- During the growth phase of the business, the management may be seeking new strategic partnerships that will increase the company’s dominance and control in the market.

- They are a measure of a company’s financial health and they can promote stability and growth.

- During this process, funds from accumulated retained earnings are reinvested instead of being paid out as dividends to shareholders.

- Since you’re thinking of keeping that money for reinvestment in the business, you forego a cash dividend and decide to issue a 5% stock dividend instead.

- This statement is often used to prepare before the statement of stockholder’s equity because retained earnings is needed for the overall ending equity calculation.

The equity statement is important because it indicates management’s confidence in the company’s future growth. If management believes the company needs capital to fuel growth, they’ll retain earnings instead of paying them out as dividends. Finally, you can calculate the amount https://www.bookstime.com/articles/equity-multiplier of retained earnings for the current period. Just like in the statement of retained earnings formula, find the total by adding retained earnings and net income and subtracting dividends. You must use the retained earnings formula to set up your statement of earnings.

How do dividends impact retained earnings?

The company retains the money and reinvests it—shareholders only have a claim to it when the board approves a dividend. We’ll pair you with a bookkeeper to calculate your retained earnings for you so you’ll always be able to see where you’re at. This reduction happens because dividends are considered a distribution of profits that no longer remain with the company. Retained earnings are also known as accumulated earnings, earned surplus, undistributed profits, or retained income. However, if you have one or two investors in your business, you’ll want to list the amount of money distributed to them during this period. A decrease in retained earnings is not necessarily cause for alarm, as any time you invest money back into your business, your retained earnings will likely decrease.

Step 3: Determine dividends paid

Your company’s net income can be found on your income statement or profit and loss statement. If you have shareholders, dividends paid is the amount that you pay them. In contrast, a retained earnings statement focuses solely on the changes in retained earnings over a specific accounting period. The statement of retained earnings is closely connected to other financial statements, such as the balance sheet, income statement, and statement of cash flows. Retained earnings are typically a component of the equity section on the balance sheet, and they can be affected by the net income reported in the income statement. Additionally, events like dividend payments, which are part of cash flows, can impact the statement of retained earnings.

What Is the Difference Between Retained Earnings and Dividends?

If a company prides itself on developing cutting-edge technology yet continually has low retained earnings year after year, something is clearly amiss. Ending the year with a high level of retained earnings could indicate significant growth. Of course, retained earnings also need to be considered in a broader context — for example, how much you paid out in dividends. If you are a new business and do not have previous retained earnings, you will enter $0. And if your previous retained earnings are negative, make sure to correctly label it. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Modern companies use accounting software to prepare financial statements, including this one.

- Retained earnings are an equity balance and as such are included within the equity section of a company’s balance sheet.

- In conclusion, the statement of retained earnings holds significant importance in a company’s financial management.

- Companies might have restrictions due to loan agreements or legal regulations that limit their ability to distribute retained earnings as dividends or payments to shareholders.

- In conclusion, the disclosure and regulatory environment surrounding retained earnings ensures that companies properly present and report their financial information.

- Normally, these funds are used for working capital and fixed asset purchases (capital expenditures) or allotted for paying off debt obligations.

- However, for other transactions, the impact on retained earnings is the result of an indirect relationship.

- If you are completing this step manually, take the company’s total profits from the year and subtract any expenses — make sure to include any relevant deductions.

- For example, let’s create a statement of retained earnings for John’s Bicycle Shop.

- GAAP specifically prohibits this practice and requires that any appropriations of RE appear as part of stockholders’ equity.

- This statement is vital for investors to understand the profitability and financial health of a company.

You will need to list your amount of retained earnings at the end of the previous accounting period. You can obtain this information from your business’s balance sheet or previous statement of retained earnings. Now your business is taking off and you’re starting to make a healthy profit which means it’s time to pay dividends. A company’s capital allocation strategy determines how net income and paid-in capital will be employed to maximize shareholder value. Internal reinvestment of earnings forms a vital component of this strategy, as companies must evaluate the trade-offs between retaining earnings and paying dividends to shareholders. It reconciles the beginning balance of net income or loss for the period, subtracts dividends paid to shareholders and provides the ending balance of retained earnings.

댓글을 남겨주세요