First, we need to understand what manufacturing cost is, the different types of manufacturing costs as well as some examples to get context for what we’re talking about. Then we’ll provide formulas to calculate each type of manufacturing cost and the total manufacturing cost. Being able to make accurate estimates of your manufacturing costs is critical to a company’s profitability and competitive advantage. Before work hits the production line, one must know how to calculate manufacturing cost. Advancements in technology have revolutionized manufacturing processes across industries. Adopting modern technologies such as automation, robotics, and advanced manufacturing techniques can streamline operations, improve efficiency, total manufacturing cost formula and reduce labor costs.

Insights that drive efficiency

Incomplete or inaccurate financials may lead to a flawed cost analysis, affecting everything from profitability and budgeting to planning. Manufacturers who do not have an accurate picture of their spending will often have a distorted perception of their financial health, which may lead to poor budgeting. When total manufacturing costs are compared to income and revenue, profitability and overall business performance become clear. Direct labor costs include the wages and benefits paid to employees directly involved in the production process of goods or products. Accurate cost calculation helps companies identify the processes or materials that are driving up manufacturing costs and determine the right pricing of products — the keys to remaining profitable. Calculate manufacturing overhead costs by summing up your facility’s indirect expenses.

- Regularly reviewing supplier contracts and negotiating better terms can significantly impact your manufacturing costs.

- The cost of direct labor refers to the direct labor that contributes to the manufacturing of a product or a service during a given period.

- Finally, allocate overhead, which includes expenses like utilities, equipment maintenance, and factory rent.

- An Enterprise Resource Planning system is software that can help you manage all of the core supply chain, manufacturing, services, financial and other processes related to your organization.

- COGS is the cost of items that not only completed the product creation journey but were also sold to a customer.

- It, thus, helps in cost management and operational efficiency at the factory level.

Total Manufacturing Cost: Formula, Guide, & How to Calculate

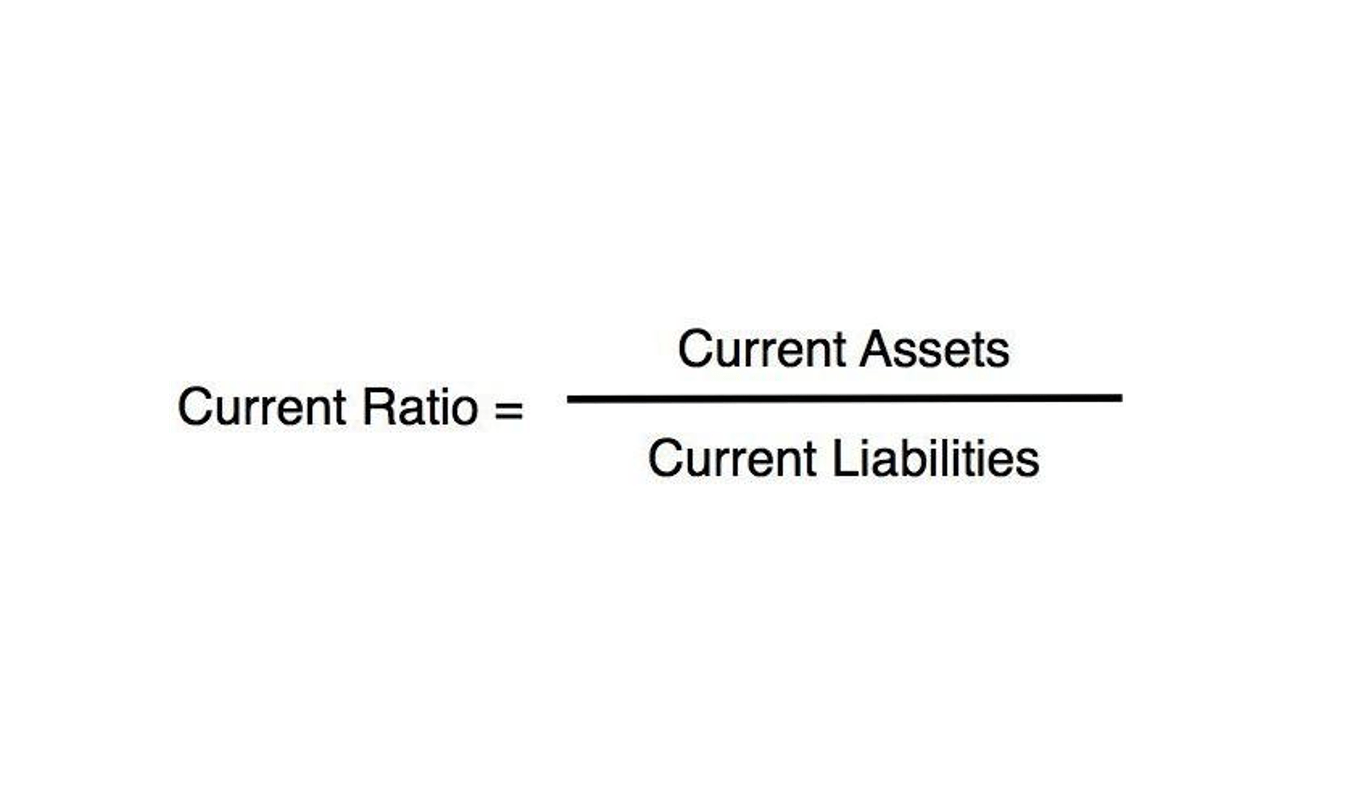

You can calculate how much it costs to turn raw materials into finished products and how much it costs to manufacture each item you produce using a simple cost formula. In this article, we will define total manufacturing cost, how it differs from production costs, and how to calculate manufacturing cost using its formula. You can calculate your total manufacturing cost by adding the total cost of direct materials, direct labor, and manufacturing overhead. However, before using the total manufacturing cost formula to calculate your costs, you need to understand what each part of the formula means. The main components of total manufacturing cost are direct materials, direct labor, and manufacturing overhead. Manufacturing Overhead includes all indirect costs required to run the production process.

- This is why raw material inventory and material purchases should only be used to calculate direct material costs.

- “When a manufacturer begins the production process, the costs incurred to create the products are initially recorded as assets in the form of WIP inventory.

- This is an important expense for manufacturing businesses to ensure profitability and sustainable growth.

- While the total manufacturing cost is related to COGM, they have distinct differences.

Challenges in Managing Manufacturing Costs

The first step for calculating total manufacturing cost is gathering cost data. This means collecting all https://www.facebook.com/BooksTimeInc relevant cost information that directly or indirectly contributes to the production of goods. After all, the accuracy of your TMC calculation depends on the precision of the data you gather.

Total manufacturing cost vs. COGM vs. COGS

To calculate total manufacturing costs, you need to add up three key components – direct materials, direct labor, and overhead costs. First, identify the cost of direct materials, which includes all raw materials used in production. balance sheet Next, calculate direct labor costs, which are the wages paid to workers directly involved in manufacturing. Finally, allocate overhead, which includes expenses like utilities, equipment maintenance, and factory rent. Total manufacturing cost refers to the total expenses involved in producing goods.

Direct Labor Calculation

Direct Labor Cost comprises the wages, salaries, and benefits paid to employees directly involved in the manufacturing process. These employees work directly on the production line and contribute directly to the creation of the goods. Rose Burn’s manufacturing overhead is $170,000 ($50,000 manufacturing supervisor gross pay + $60,000 factory rent + $45,000 factory utilities + $5,000 depreciation + $10,000 supplies). For an employee’s wages to count as direct labor, he or she must be working hands-on in the manufacturing process. Manufacturing overhead is considered an indirect cost, as it’s not directly related to the product. However, it falls into its own category as a type of indirect cost because manufacturing the product cannot take place without these overhead expenses.

What’s the difference between direct and indirect manufacturing costs?

- Regularly updating and reviewing costs will further enhance your overall cost efficiency.

- It helps manufacturers make more insightful decisions in terms of staying competitive and how production manufacturing can be profitable enough money to remain a viable business.

- The three primary components of total manufacturing cost are direct materials, direct labour, and manufacturing overheads.

- Simultaneously, the managers can reduce the indirect manufacturing overheads by saving on utilities.

- Total manufacturing costs are often conflated with the cost of goods manufactured (COGM).

- It can be determined by dividing the total number of working hours (regular and overtime) by the number of units produced during a certain period.

Major cost components of manufacturing are machine equipment cost, energy costs, manufacturing expenses, administrative expenses and other hidden costs. Few of above costs are taken as “Capital costs” and rest are as “Operating expenses”. The calculations for all these costs give the manufacturer a clear picture of what it costs to produce each dog house and, therefore, what price the dog house should sell for. This allows the manufacturer to determine their profit margin and also productivity level, for producing more dog houses in the same amount of time could lead to greater profits if there’s a market need. Add together all manufacturing costs, noting which are variable and fixed. Then, subtract the variable costs from the total and multiply it by the amount of product for the given production period.

For this purpose, she determines the total manufacturing cost per unit and finds out that the cost of manufacturing a chair has gone up by 10% due to the rise in labor and material costs. Hence, he suggests that top-level management increase the sales price of chairs. After choosing an allocation method, divide the total overhead costs across your products based on machine hours or labor hours. For example, if your factory’s overhead costs are $10,000 and your machines run for 1,000 hours, you would allocate $10 in overhead per machine hour. This allocation ensures that overhead is fairly distributed among products, giving you a more accurate picture of total manufacturing costs. Indirect costs include expenses like utilities, rent, maintenance, and indirect labor.

댓글을 남겨주세요